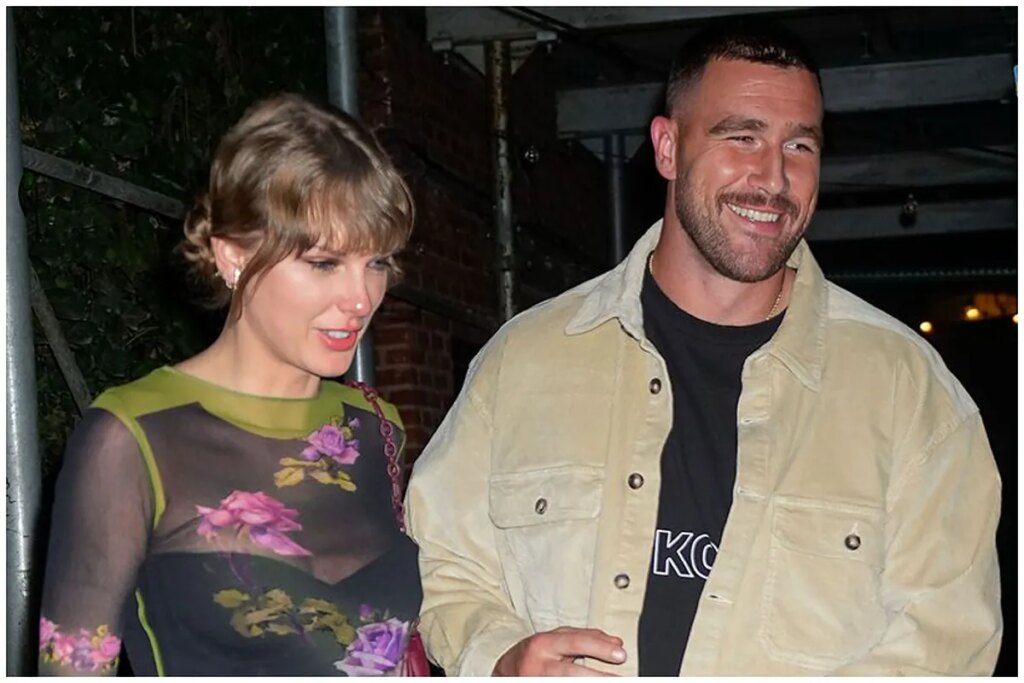

Taylor Swift and NFL star Travis Kelce recently announced their engagement, causing a big wave of media attention everywhere on Earth and bringing joy to fans all around the globe too.

Their union has been freely embraced, but a recent column in Fox News implies a silent threat of stardom: the complex tax obligations imposed on entertainers and athletes, popularly referred to as “jock taxes.”

A high-profile engagement

Swift and Kelce’s romance means a lot for both, as their dating times were widely reported by the media and fans everytime. As much as the tabloids thrive on romances, the two have to physically deal with the complexities of state income taxes, which can affect not only their incomes but also their support teams.

“Jock taxes” are state income taxes imposed on performers and entertainers on their pay while working or playing in other states beyond their home one. Individuals can be called on to file tax returns in multiple states for even temporary work, becoming a stressful and expensive task. For celebrities like Swift and Kelce, it is not simple but manageable to deal with these filings, however for most of the support staff, the burden is much heavier.

The effect on everyday workers

Andrew Wilford’s report points out that support workers such as trainers, security guards, and production assistants are sometimes taxed the same multi-state tax load as their star co-workers. Such workers, who work under common salaries, are burdened with added costs and bureaucracy from state taxes, which is a reflection of a missing parity in the enforcement of tax policy upon lower ranks in sports and entertainment industries.

Experts manifest that the existing jock tax law goes against lower-income workers. Simplifying or limiting these taxes could ease the economic impact on support staff, establishing a fair framework that does not disproportionately put the price of multi-state labor on lower-income individuals.

Read the full article here